The National Assembly is inviting public opinions and submissions regarding the Division of Revenue (Amendment) Bill, 2024. Samuel Njoroge, Clerk of the National Assembly, announced that contributions can be sent via email or delivered in person to Parliament, with a submission deadline of Thursday, August 1.

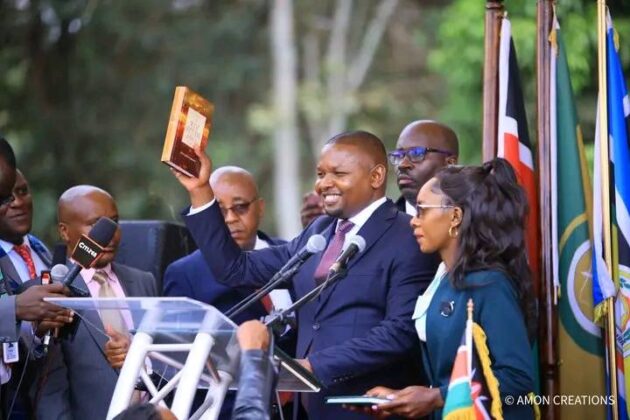

The bill, introduced by Ndindi Nyoro, Chairperson of the Budget and Appropriations Committee, responds to a notable decrease in national revenues for the 2024/25 fiscal year, totaling Sh346 billion. This reduction includes Sh326 billion less for the National Government and a Sh20 billion cut for County Governments.

Additionally, the bill proposes allocating Sh7.8 billion to the Equalization Fund, representing 0.5 percent of the most recent audited revenue, as approved by the National Assembly. Public input is crucial to ensure an inclusive approach to the proposed changes in revenue distribution.

This call for public engagement follows recent nationwide protests against the Finance Bill, which suggested new taxes to generate additional revenue. The Finance Bill was met with widespread resistance due to concerns about its potential effects on the cost of living and economic inequality.

Protesters, including civil society organizations, political leaders, and citizens, argued that the proposed taxes would disproportionately burden lower and middle-income households. The protests escalated into violence in several regions, resulting in over 60 deaths and highlighting deep public frustration and anger.

The government, responding to the unrest, withdrew the Finance Bill for further review. This withdrawal, however, created a significant budgetary gap, prompting the introduction of the Division of Revenue (Amendment) Bill as a means to address the reduced revenue expectations. The proposed reductions in allocations to both the National and County Governments are part of a strategy to manage the fiscal shortfall.

Cuts in the National Government’s allocation will affect various ministries and departments, potentially leading to reduced expenditures. Similarly, County Governments, which depend heavily on transfers from the national exchequer, may struggle to maintain service delivery and development projects.

The proposed allocation to the Equalization Fund, totaling Sh7.8 billion, aims to address disparities in marginalized areas. While this represents 0.5 percent of the most recent audited revenue, some view it as insufficient to meet the needs of these regions.

Public consultation on the Division of Revenue (Amendment) Bill is a vital step in the legislative process, allowing stakeholders, including civil society organizations, business groups, and citizens, to voice their opinions and concerns. This input is essential to ensure the final legislation reflects the public’s needs and aspirations.

The outcome of this consultation will significantly impact Kenya’s fiscal policy and economic planning. The government faces the dual challenge of fiscal consolidation and meeting public demands for services and development. Cutting allocations is part of a broader effort to manage the country’s debt levels and ensure fiscal sustainability.