Top News

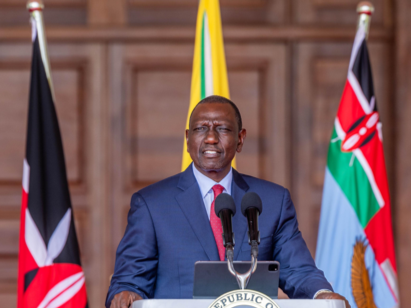

Kenya’s President William Ruto has appointed several prominent opposition figures previously his fiercest critics to key positions in his Cabinet in a move that has ignited widespread controversy. Among the new appointees are Hassan Joho, Wycliffe Oparanya, and John Mbadi—all high-ranking members of the Orange Democratic Movement (ODM). Joho and Oparanya, who served as ODM…

President William Ruto has Nominated Douglas Kanja as the Inspector General of Police following the resignation of Japhet Koome on July 12, 2024. Kanja, who began his law enforcement career in 1985, has served in various high-ranking positions over his nearly four-decade-long career. His notable roles include Deputy Inspector General of the Kenya Police Service,…

In a remarkable display of unity and resolve, Generation Z is gearing up for a massive protest in Nairobi, calling for demonstrators from all 47 counties of Kenya to converge on the capital. This mobilization follows a series of protests that have swept the nation since June, sparked by widespread dissatisfaction with the recently passed…

Embakasi East Member of Parliament Babu Owino has voiced his frustration following the acceptance of Cabinet Secretary positions by four Orange Democratic Movement (ODM) members, nominated by President William Ruto. Declaring himself the chief opposition leader, Owino vowed to continue championing the interests of Kenyans from his position in the Opposition. “From today onwards, I…

The author of “Manyatta” is a master storyteller with a penchant for weaving intricate narratives that blend the fantastical with the deeply human. With a background in environmental science and a lifelong passion for exploring the delicate balance between nature and humanity, the author brings a unique perspective to their writing. Known for their sharp…

NELSON Ndereva’s book Why I Love Running narrates the art of name swapping, runners poaching and deceit in Kenyan Athletics…https://a.co/d/76cfZsV That year Eastern provincial cross-country championship was in Machakos town. We arrived the night before and stayed with Charles in the same hotel room. We warmed up as team and lined up for the race….

President William Ruto has finalized his Cabinet appointments, naming the remaining Cabinet Secretaries in a recent announcement. According to Kenyan law, the President is permitted to appoint a minimum of 15 and a maximum of 22 Cabinet Secretaries. Last week, President Ruto appointed 10 Cabinet Secretaries, including Prime CS and CS for Foreign Affairs, Musalia…

Dr. Waqo Dulacha Ejersa has been appointed as the new Chief Executive Officer of the Kenya Medical Supplies Authority (KEMSA), succeeding Dr. Andrew Mulwa, who has served as acting CEO since March 2023. Dr. Ejersa brings over 25 years of extensive experience in health policy and implementation to his new role. His distinguished career includes…

President William Ruto has announced a significant reshuffling of his Cabinet, appointing Soipan Tuya as the new Defence Minister while transferring Aden Duale to the Ministry of Environment. This decision was conveyed to the Speaker of the National Assembly, Moses Wetang’ula, through an official communication. The announcement coincided with Wetang’ula’s presentation of 11 new Cabinet…

By AFP As Kenya’s renowned distance runners prepare for the Olympics, they face the daunting challenge of overcoming a series of doping scandals that have tarnished the country’s reputation as a track and field powerhouse. The latest setback came when marathon runner Beatrice Toroitich received a lifetime ban after her third positive drugs test. This…

Mkarimu Media Inc. Copyright | Powered by WordPress | Theme by TheBootstrapThemes